Motorbike Multi Bike Insurance: Why Pay-Per-Mile Wins

left for contents

There’s nothing like having a different machine for every mood. A nimble commuter that slices through city traffic (like my ADV160), a weekend firecracker for canyon carving (like my CRF motard), and a big-hearted tourer that eats highways for breakfast (my beloved Ultra Limited).

Maybe you’re like me and keep a garage full of bikes ready for whatever your next whim demands. Yet when the insurance bill arrives, it can feel like we’re being punished for loving motorcycles.

Truth is, most motorcycles spend vastly more time parked than moving. A recent survey of ~500 riders showed that about half ride less than 1,000 miles a year. But traditional motorcycle insurance charges the same rate whether that bike is out all day, every day or only once a year.

We’re paying full‑freight premiums for bikes that rarely see the light of day. That doesn’t sit right with me, and I suspect it doesn’t sit right with you either.

Those premiums multiply quickly when you own multiple motorcycles.

Traditional Multi-Bike Insurance

Traditional multi‑bike policies bundle all your motorcycles under one roof. There’s one renewal date, one set of paperwork, and usually a small multi‑bike discount (maybe 10% off). You can often tailor coverage per bike and add other riders under a single plan. It sounds convenient, and it is.

But there’s a catch: Traditional insurance assumes each bike is ridden year‑round. Whether your tourer racks up 10,000 miles or sits under a cover for months, you pay the same. Multi‑bike discounts help, yet they don’t solve the core issue—most of us aren’t riding all our bikes all the time.

The Pay-Per-Mile Difference

This is where pay-per-mile comes in. VOOM is the first company I know of that offers this in the USA.

Instead of a flat annual fee, you pay a small base rate plus a per‑mile charge. Coverage can be customised to match traditional policies: liability, collision, comprehensive and medical are all on the table.

Here’s how it works for VOOM: at the start of your coverage and every 6 months thereafter, you snap a photo of your odometer in their app. No GPS trackers or black boxes, just your odometer reading. If you forget, VOOM charges a default estimate and corrects it when you upload your mileage.

Your bill reflects the miles you actually rode, not the months your bike sat idle.

For owners of multiple bikes, this is huge. Each bike on your VOOM policy has its own per‑mile rate. The daily commuter pays its share. The tourer that only sees the horizon twice a year barely moves the needle. The back‑roads blaster only costs you when you twist the throttle. It’s insurance that matches how we ride.

Coverage is always live. Whether you ride every day or just once, your bikes are insured. Depending on your package, they’re also protected against loss or damage even when parked. Including damage, theft, fires, floods and more that might harm your bike.

Is Pay-Per-Mile Right for You?

The math makes sense if you’re in the “riding less” camp. Your exact pricing is dependent on your state, history, bike, etc just like any insurance where you have to get a specific quote for your situation.

But VOOM estimates you could save up to 60% compared with traditional insurance if you’re under about 2,000 miles annually.

Using averages from Consumer Shield and data from the state of Arizona for VOOM, the gap becomes clear with the numbers side by side.

| Bike | Annual Mileage | Traditional Annual Premium* | Estimate for VOOM Pay-Per-Mile** |

| Standard | 1,000 miles | $1,380 | $911 |

| Tourer | 1,500 miles | $900 | $693 |

| Sport | 1,000 miles | $1,600 | $1,112 |

| Total (3 Bikes) | 3,500 miles | $3,900 | $2,716 (30% savings) |

* Average annual cost for motorcycle insurance by type. Data as of August 2024. Source: Consumer Shield.

** Data for the state of Arizona. Actual quotes depend on rider profile, location, and mileage.

If you pile on miles, a flat annual policy might still be cheaper. But if you’re like most riders who own multiple bikes and split mileage across them, paying only for the miles you ride just makes sense.

How to Get Started

Signing up for pay-per-mile insurance for multiple bikes is refreshingly simple, at least when getting a quote from VOOM.

Visit their site, enter your details and bikes, and get a quote. Once enrolled, all you do is send a monthly odometer photo from each bike.

There’s no hardware to install and no location tracking. Your bikes remain fully covered whether they’re fired up or sitting in the garage.

If you’ve been stuck with flat premiums for years, the process almost feels too simple. No hidden trackers, no fine print, and minimal cost for bikes that never leave the garage. Just coverage that finally lines up with the way you ride.

FAQ: Motorbike Multi Bike Insurance and VOOM

Riders always have questions once insurance comes up, and with good reason. Multi bike coverage sounds simple until you look at the fine print, and a new model like pay-per-mile raises its own set of doubts.

I’ve pulled together the most common questions I hear from riders so you can see how traditional motorbike multi bike insurance stacks up against pay-per-mile (VOOM, in this case) in practice. For a deeper dive, check out Cycle News’ analysis highlighted by VOOM, which puts their model to the test.

Is motorbike multi bike insurance always cheaper than separate policies?

Traditional multi bike insurance gives you one annual fee for all your motorcycles, which can be cheaper than buying three separate policies. But it still assumes each bike is on the road year-round, so if you ride less or split your miles across machines, you often end up overpaying versus a pay-per-mile quote.

How does VOOM calculate what I owe?

VOOM charges a small base monthly fee plus a rate for every mile you ride. The photos you take of your odometer every six months set your bill. No trackers, no hardware, just the miles on your clock.

What if I ride more than expected?

If you put in serious mileage, the per-mile charges add up. If you know you’re going to put on a lot of miles, traditional motorbike multi bike insurance may come out cheaper. While VOOM is designed for riders with modest or seasonal mileage (they say under 2,000 miles annually), it’s worth it to ask for a quote anyway.

Does VOOM cover the same things as regular insurance?

Yes. You can choose liability only or full coverage that includes collision, comprehensive, medical, and even roadside assistance. The difference is in the billing, not the protection. You can choose to add comprehensive options to cover theft, flood and fire damage and more as well – just like traditional insurance.

Which riders save the most with VOOM?

Multi-bike owners who spread their miles thin across several motorcycles, less than 2,000 miles per year per bike. I.E. seasonal riders who park through winter, weekend riders who only put a thousand miles on the clock every summer. That’s where the pay-per-mile model shines.

Many riders keep a tourer parked for months under a cover before it finally gets rolled out again for a big trip. If that sounds like you, this guide to the best motorcycle covers will help you keep yours safe until it’s ready to ride.

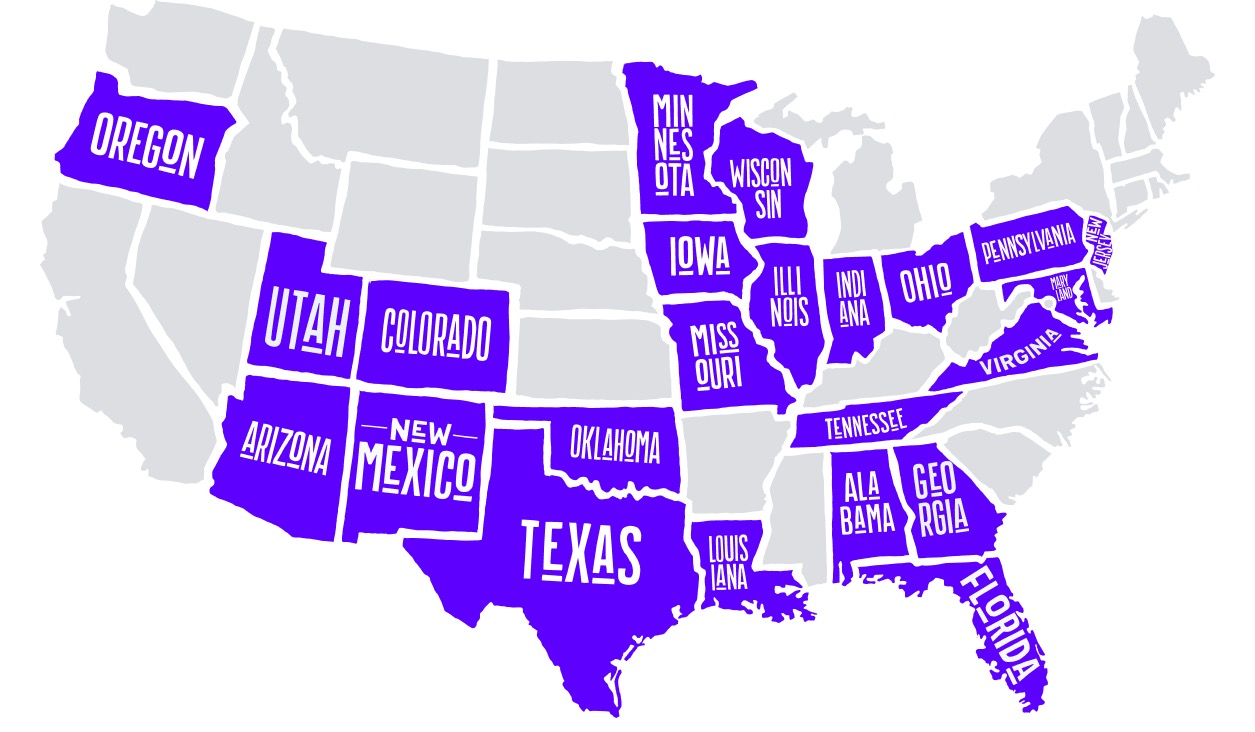

Is VOOM available everywhere in the U.S.?

Not yet. They are expanding fast, but availability depends on your state. The best move is to check directly on VOOM’s site to see if they write policies where you live.

Related

Classic Motorcycle Insurance: Protect Your Ride’s Legacy

If your ride’s got history, it deserves protection to match. Classic motorcycle insurance keeps legends alive and riders worry-free.