Best Motorcycle Insurance for Beginners: 2025 Picks

left for contents

Getting your motorcycle endorsement feels like a rite of passage. There’s nothing like that first ride on your own bike. Unfortunately, the next step is shopping for insurance — and for first‑time riders that can feel as intimidating as a rain‑slicked mountain pass. The truth is, new riders often pay more for coverage even if they’ve never crashed (businessinsider.com), and your first bike’s horsepower can nearly double your insurance rate (valuepenguin.com).

Some insurers make it easy to add coverage for borrowed bikes or training accidents, while others bury extras behind confusing packages. With dozens of options and a world of fine print, it’s hard to know where to start.

To help you hit the road confidently, this guide compares the top beginner‑friendly motorcycle insurers, explains why premiums are higher for first‑timers, and walks you through the coverage you actually need (and what’s optional). Whether you ride a 250cc starter bike or a middleweight cruiser, read on to find affordable protection without sacrificing peace of mind.

Quick Comparison: Best Motorcycle Insurance Options for New Riders

| Insurance option | Best for | Typical cost for young riders (month) | Why it’s beginner friendly |

|---|---|---|---|

| Progressive (recommended) | All‑around choice | Min: ~$16 / Full: ~$52 (moneygeek.com) | 15 coverage types, safety‑apparel and custom‑parts coverage, 12 discounts including pay‑in‑full, early quote & safety course |

| GEICO | Low premiums for riders under 25 | Min: ~$24 / Full: ~$90 (moneygeek.com) | Second cheapest for young riders, strong customer service scores, discounts for safety courses, multi‑policy, good student & military |

| Dairyland | Custom or modified bikes | Min: ~$25 / Full: ~$91 (moneygeek.com) | Covers vintage, custom and high‑performance bikes other insurers reject; offers married‑rider and homeowner discounts |

| Markel/VOOM | Low‑mileage or seasonal riders | Base ~$15 + ~$0.09 per mile (revzilla.com) | Pay‑per‑mile model rewards occasional riders; three preset coverage tiers (Essentials, Popular, Extended) and customizable options |

| Harley‑Davidson Insurance | Budget‑conscious beginners (any bike brand) | Min: ~$14 / Full: ~$25 (moneygeek.com) | Lowest average premiums ($234 annually), covers all motorcycle brands, 17 coverage options with 13 discounts (H.O.G., mature rider, multi‑bike) |

Note: Cost estimates reflect MoneyGeek’s 2025 data for young riders and full‑coverage policies. Actual premiums vary based on your state, bike type, driving record and credit history. For VOOM, pricing includes a monthly base plus a per‑mile fee.

Why New Riders Pay More for Insurance

If you just earned your motorcycle license and discovered that your quote is higher than your friend’s, you’re not alone. Age and experience drive premiums more than any single factor. Business Insider notes that motorcycle insurance for young riders with little experience is significantly more expensive than for someone in their 30s with ten years of riding (businessinsider.com). Insurers base rates on risk, and accident statistics show that riders under 25 and those with less than three years of riding history are more likely to be involved in a crash.

Risk Profile and Experience

- Younger and inexperienced riders: Age and experience correlate with crash rates, so insurers often charge 30–50 % more for riders under 25. An 18‑year‑old with one year of experience will pay much more than a 30‑year‑old with ten years.

- Bike type and horsepower: Powerful sport bikes and high‑horsepower machines cost more to insure because they are more likely to be involved in high‑speed crashes. ValuePenguin explains that sport bikes and street bikes are typically the most expensive to insure.

- Location and riding habits: Riders in urban areas face higher accident and theft rates, which translate to elevated premiums. Frequent riders who log thousands of miles also pay more than weekend cruisers.

- Driving record: A single speeding ticket or at‑fault accident triggers higher premiums. MoneyGeek’s rate tables show that riders with violations pay $10–$16 per month more for minimum coverage than those with clean records.

Why “No Crash History” Doesn’t Mean “Low Cost”

Insurers rely on actuarial data rather than your individual history. Even if you’ve never dropped a bike, statistically you fall into a group that crashes more often. Less‑experienced riders are also more likely to buy entry‑level gear and cheaper bikes, which lack advanced safety features. Over time, your rate drops as you build a clean riding record, complete safety courses and upgrade to a bike with anti‑lock brakes.

How Much Will You Pay?

Estimates vary widely depending on where you live and the coverage you select. MoneyGeek reports that the national average for minimum motorcycle liability insurance is about $12 per month and full coverage averages $30 per month. However, those figures are based on a 40‑year‑old rider with no violations. For new riders under 25, premiums jump dramatically. Using MoneyGeek’s 2025 data:

- Progressive: Young riders pay around $16/month for minimum and $52/month for full coverage.

- GEICO: Young riders pay roughly $24/month for minimum and $90/month for full.

- Dairyland: Young riders pay about $25/month for minimum and $91/month for full.

- Markel/VOOM: The base rate is $27/month for minimum, plus a per‑mile fee that results in $134/month for full coverage if you ride enough miles.

Remember, rates vary by state. For example, Forbes’ analysis of eight high‑registration states found average monthly full‑coverage rates ranging from $100 in Wisconsin to $318 in California, with an overall average of $209 per month (forbes.com). Even if you ride a small machine, living in a high‑cost state can double your premium.

💰 Curious what riders actually pay across the U.S.? Check out How Much Is Motorcycle Insurance? Real Costs & Tips.

Coverage Basics Every Beginner Should Know

Motorcycle insurance isn’t just about repairing your bike after a crash. It provides financial protection if you injure someone, damage property, or get hit by an uninsured driver. The Insurance Information Institute breaks down the core coverage types (iii.org):

- Liability insurance – Covers bodily injury and property damage you cause to others. This is mandatory in most states and does not pay for your own injuries or bike repairs.

- Collision coverage – Pays to repair or replace your bike after a crash with another vehicle or object. You’ll choose a deductible, which is the amount you pay before the insurer picks up the tab.

- Comprehensive coverage – Covers non‑collision damage such as theft, vandalism or weather‑related losses.

- Coverage for custom parts and accessories – Many policies limit coverage to factory parts; accessory coverage protects aftermarket parts, riding gear and modifications.

- Uninsured/underinsured motorist (UM/UIM) – Pays for your medical bills and property damage if you’re hit by someone with no insurance or inadequate coverage. Given the high rate of uninsured drivers in many states, UM/UIM is critical.

- Medical payments or personal injury protection (PIP) – Some states offer medical payments coverage that helps pay your medical bills regardless of fault. PIP is similar but can cover lost wages and other expenses depending on state laws.

Most insurers also offer add‑ons like roadside assistance, towing and rental reimbursement. When you’re new to riding, a guest passenger liability endorsement is important if you plan to carry passengers.

How to Choose the Right Coverage as a Beginner

Do You Need Full Coverage?

Full coverage combines liability, collision and comprehensive protections. While liability is legally required, new riders often benefit from full coverage:

- New or financed bikes: If your bike is brand‑new or financed, lenders require collision and comprehensive. Replacing a motorcycle after a total loss is far more expensive than paying the additional premium each month.

- Living in high‑risk areas: Urban riders and those in theft‑prone areas should carry comprehensive coverage to protect against theft and vandalism.

- Peace of mind: Beginners are more likely to drop a bike in a parking lot or misjudge a corner. Collision coverage keeps these mistakes from draining your savings.

However, full coverage costs more. If you ride an inexpensive or older bike that you could replace out‑of‑pocket, minimum liability coverage may suffice. MoneyGeek shows minimum liability costs are about half the price of full coverage for adults. Evaluate your bike’s value and your tolerance for risk.

Consider Add‑Ons Wisely

Add‑ons can enhance your policy but also increase cost. For beginners, look for:

- Roadside assistance and towing: Getting stranded far from home can be frustrating. Many insurers include roadside assistance for a few extra dollars per year.

- Safety apparel coverage: Progressive’s safety apparel coverage pays to replace helmets, jackets and boots after a covered loss.

- Replacement cost or new‑bike replacement: Some insurers will pay the original purchase price (or agreed value) rather than depreciated value if your bike is totaled. Dairyland offers OEM parts replacement for custom bikes.

- Accessory coverage: If you’ve added aftermarket pipes, bags or electronics, ensure your policy covers custom parts.

Balance Deductibles and Premiums

Choosing a higher deductible lowers your monthly premium. Forbes notes that raising your deductible can lead to significant savings. Just be sure you have enough savings to cover the deductible if you file a claim.

Discounts and Programs That Help New Riders Save

Insurance companies offer a variety of discounts that can dramatically cut premiums. Many of these are tailored to first‑time riders or those improving their riding skills.

💡 Looking to stretch your budget? Here’s how to find Cheap Motorcycle Insurance: Smart Ways to Save Safely.

Safety Course Discounts

Completing a Motorcycle Safety Foundation (MSF) course not only builds skills but can reduce your rate by up to 10 %. The Insurance Information Institute recommends training course discounts for riders under 25 and those who have had accidents. MoneyGeek points out that while many providers advertise a 10 % reduction, the actual savings are often around $5 per year — still worthwhile for the safety benefits.

Riding and Personal Profile Discounts

According to MoneyGeek, insurers offer discounts for:

- Good rider – Accident‑free for three years saves around 6 %.

- Defensive or MSF course – Typically up to 10 %, though real savings may be modest.

- Motorcycle endorsement and license – Having the proper endorsement can reduce premiums by 9–8 %.

- Mature rider – Riders over 40 with more than five years experience often qualify for lower rates.

- Motorcycle safety instructor or club membership – Instructors can receive up to 20 % off, while club membership discounts are usually small.

- Military and government employees – Many insurers offer 5–9 % discounts for active‑duty personnel.

Active-duty or veteran rider? Discover exclusive benefits in our guide to Military Motorcycle Insurance for U.S. Service Members.

Vehicle and Equipment Discounts

Installing anti‑lock brakes or approved anti‑theft devices can shave 4–6 % off your premium. Progressive and GEICO also reward riders who add security systems to deter theft.

Policy‑Related Discounts

- Pay in full – Paying your annual premium upfront yields the biggest discount (up to 21 %), and Progressive’s pay‑in‑full discount is one of the most generous.

- Quote in advance – Requesting a quote at least one day before the policy begins saves money.

- Multi‑policy or multi‑bike – Bundling motorcycle and auto policies or insuring multiple bikes can cut 13–16 % off premiums.

- Auto‑pay and electronic documents – Setting up automatic payments or going paperless yields small savings.

- Loyalty and transfer – Staying with the same insurer or switching from another company may earn discounts; Markel’s transfer discount is around 10 %.

Multi‑Company and Specialized Programs

- Progressive offers 12 discounts, including accident forgiveness and a disappearing deductible that drops 25 % each claim‑free period.

- Dairyland rewards married riders, homeowners and members of recognized motorcycle groups.

- GEICO provides good‑student and federal‑employee discounts, making it attractive to college‑age riders and government workers.

- Harley‑Davidson offers 13 discounts ranging from H.O.G. membership to original‑owner savings.

- Markel/VOOM focuses on low‑mileage riders; paying annually or quarterly can save 15–19 %. Its pay‑per‑mile pricing means you never pay for unused miles.

VOOM and Other Pay‑Per‑Mile or Usage‑Based Options

Traditional motorcycle insurance charges a fixed premium based on assumed annual mileage. If you only ride weekends or store your bike for six months of the year, you might be overpaying. Pay‑per‑mile insurance solves this problem by charging a low base fee plus a few cents per mile.

How VOOM Works

VOOM is a collaboration between insurtech start‑up VOOM and Markel. The company’s pay‑per‑mile model is designed for three types of riders: occasional riders, owners with multiple motorcycles, and “dynamic” riders whose mileage fluctuates by season. Riders take a photo of their odometer each month; premiums are calculated using a base fee (around $15 per month) plus roughly $0.09 per mile. VOOM claims that riders can save up to 60 % annually compared with traditional policies.

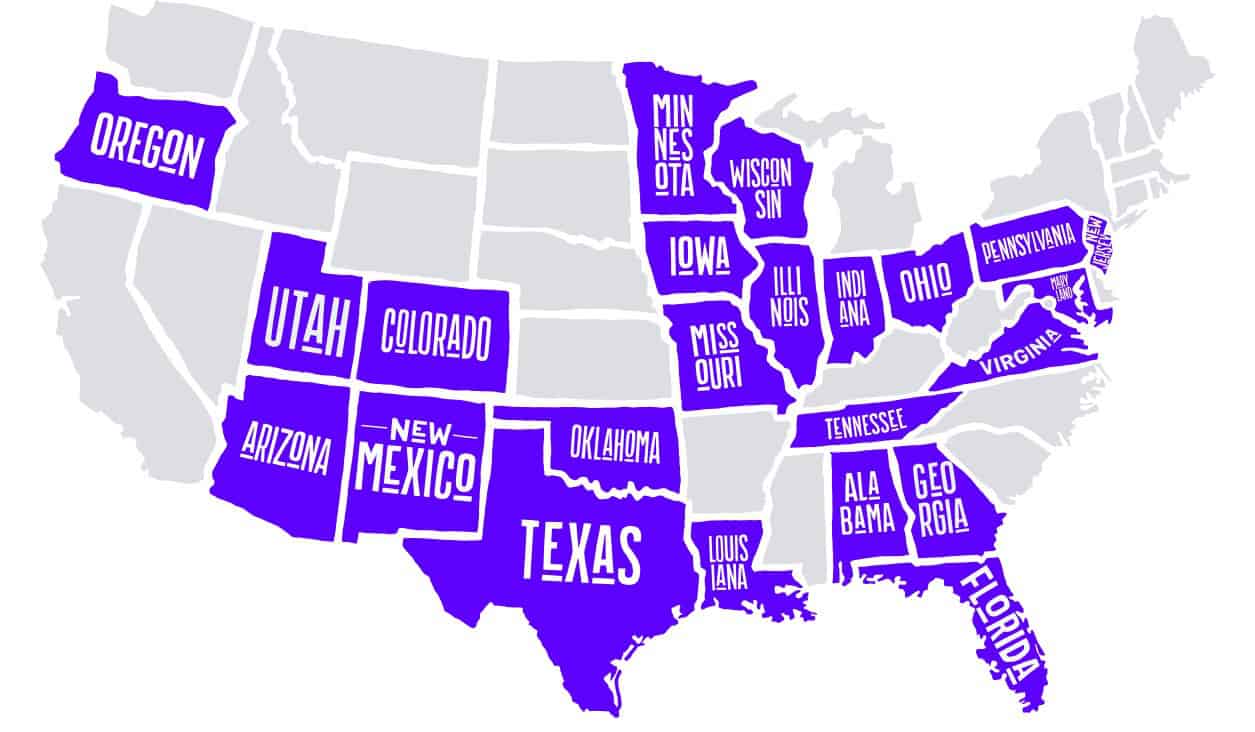

Policies are available in several states (Arizona, Indiana, Ohio and Illinois, with plans to expand). Three preset packages make quoting simple:

- Rider’s Essentials – Basic liability and uninsured motorist protection.

- Popular – Higher liability plus collision and comprehensive coverage.

- Extended – Premium coverage including higher limits, comprehensive, collision and emergency roadside assistance.

Riders can also customize coverage and add extras via the online tool. The monthly bill caps at a set mileage, so you’re not charged indefinitely if you ride a lot in one month.

👉 Want to dive deeper into pay-per-mile options? Read our guide: Motorbike Multi Bike Insurance: Why Pay-Per-Mile Wins.

Pros and Cons of Pay‑Per‑Mile Programs

Benefits:

- Saves money for low‑mileage riders – Weekend riders or those with multiple bikes often pay less than with flat‑rate policies, especially if annual mileage is under 1,500 miles.

- No hardware required – Unlike some auto usage‑based programs, VOOM does not need a dongle or GPS tracker; you simply upload an odometer photo.

- Flexible coverage tiers – VOOM’s preset packages simplify choices for new riders.

Drawbacks:

- Limited availability – As of 2025, VOOM operates in only a handful of states. Other pay‑per‑mile insurers for motorcycles are scarce.

- Potentially higher costs for high‑mileage riders – If you ride more than ~2,000 miles per year, per‑mile fees can exceed traditional premiums.

- Monthly odometer submissions – Forgetting to upload your odometer photo means you’re charged a predetermined amount.

Overall, pay‑per‑mile insurance is ideal for beginners who ride on weekends, have multiple bikes, or live in cold climates where riding is seasonal. Compare quotes from VOOM and traditional insurers to see which offers the best deal for your situation.

Buying Guide: What to Look For in Beginner Motorcycle Insurance

Choosing the right policy goes beyond price. As a new rider, prioritize these factors when shopping for coverage:

1. Ease of Claims and Customer Support

Reading claim reviews and complaint ratios helps you gauge an insurer’s service. Dairyland, for example, has a complaint ratio 52 % below the national average. Progressive and GEICO both score well for customer service and offer straightforward online claims portals. Harley‑Davidson Insurance reports a complaint ratio 42 % below average, which is reassuring when you need help after a crash.

2. Coverage Flexibility

Look for insurers that offer standard protections plus optional extras tailored to beginners:

- Safety apparel and accessory coverage: Progressive automatically covers $3,000 of accessories and will replace your helmet and gear after a crash.

- Replacement cost and custom bike coverage: Dairyland provides OEM parts replacement for custom or vintage bikes.

- Guest passenger liability: Essential if you plan to ride with a pillion passenger.

- Roadside assistance: Offered by most insurers and invaluable when you’re stuck with a flat tire far from home.

🛠️ Don’t get stranded—see our full breakdown on Motorcycle Breakdown Insurance: Keep Your Ride Moving On.

3. Discounts for New Riders

Ask about every possible discount. Progressive’s pay‑in‑full discount can slash premiums by up to 21 %, while GEICO’s good‑student discount rewards college riders with solid grades. Taking an MSF course not only makes you a safer rider but also qualifies you for discounts at nearly every insurer.

4. Usage‑Based and Seasonal Options

If you don’t ride year‑round or have a collection of bikes, consider a pay‑per‑mile policy like VOOM. It can lower costs significantly if you ride less than 1,500 miles annually. Alternatively, some insurers allow you to lay up coverage (reduce it to comprehensive only) during the off‑season.

⏱️ Only riding for a few weeks or months? Learn more about Temporary Motorcycle Insurance for Short-Term Riders.

5. Financial Strength and Availability

Check AM Best ratings to ensure the company can pay claims. Progressive and GEICO have superior ratings, while Markel and Harley‑Davidson hold excellent grades. Also consider state availability: Markel/VOOM is only offered in about half the states.

6. Pricing Transparency

Get quotes from at least three companies. MoneyGeek emphasizes comparing quotes as the surest way to find savings. Insurers like Progressive and GEICO provide instant online quotes, whereas Harley‑Davidson sometimes requires a phone call.

7. Long‑Term Value

Your first policy sets the stage for future premiums. Some insurers reward loyalty with disappearing deductibles and accident forgiveness, so ask about benefits that kick in after a few claim‑free years. Others, like Dairyland, offer significant homeowner and married‑rider discounts that may matter more once your life circumstances change.

Final Thoughts

Finding the best motorcycle insurance for beginners isn’t about chasing the lowest premium. It’s about striking a balance between coverage, cost and confidence. New riders face higher rates because they’re statistically more likely to crash, but smart choices can mitigate the cost. Prioritize liability, collision and comprehensive coverage if your bike is new or financed. Take advantage of training courses and maintain a clean record to lower your rates over time.

For low‑mileage or seasonal riders, usage‑based options like VOOM’s pay‑per‑mile plan can offer significant savings. Most importantly, shop around — quotes are free, and the differences between companies can add up to hundreds of dollars per year.

As you gain experience and upgrade your skills, your premiums will fall. Until then, use this guide to identify the right coverage, ask the right questions, and ride with the peace of mind that comes from knowing you’re protected.

Related

Classic Motorcycle Insurance: Protect Your Ride’s Legacy

If your ride’s got history, it deserves protection to match. Classic motorcycle insurance keeps legends alive and riders worry-free.