Temporary Motorcycle Insurance for Short-Term Riders

left for contents

Need motorcycle insurance for just a week or two? You’re not alone. Many riders only need coverage for a few days or a couple of months—maybe for a rental, a test ride, or because you’re a low‑mileage seasonal rider. Yet finding an actual “one day” or “week‑long” motorcycle policy is harder than it sounds.

Most insurers don’t actually sell daily motorcycle insurance; instead they offer annual policies that you can cancel or adjust. Even pay‑as‑you‑go insurers like VOOM only offer coverage in select states. And the “winter lay‑up” policies widely discussed on forums rarely exist at major insurers. This guide—written from a rider’s perspective—cuts through the noise and shows what really works for short‑term coverage.

Below you’ll find a comparison of the most realistic options available in 2025, followed by detailed explanations of coverage types, who needs temporary insurance, cost ranges, and a buying guide to help you decide. All information is based on current sources from U.S. insurers and industry publications.

Temporary Motorcycle Insurance Options in the U.S.

| Option | Coverage Duration & Details | Best Use Case | Approximate Cost & Availability |

|---|---|---|---|

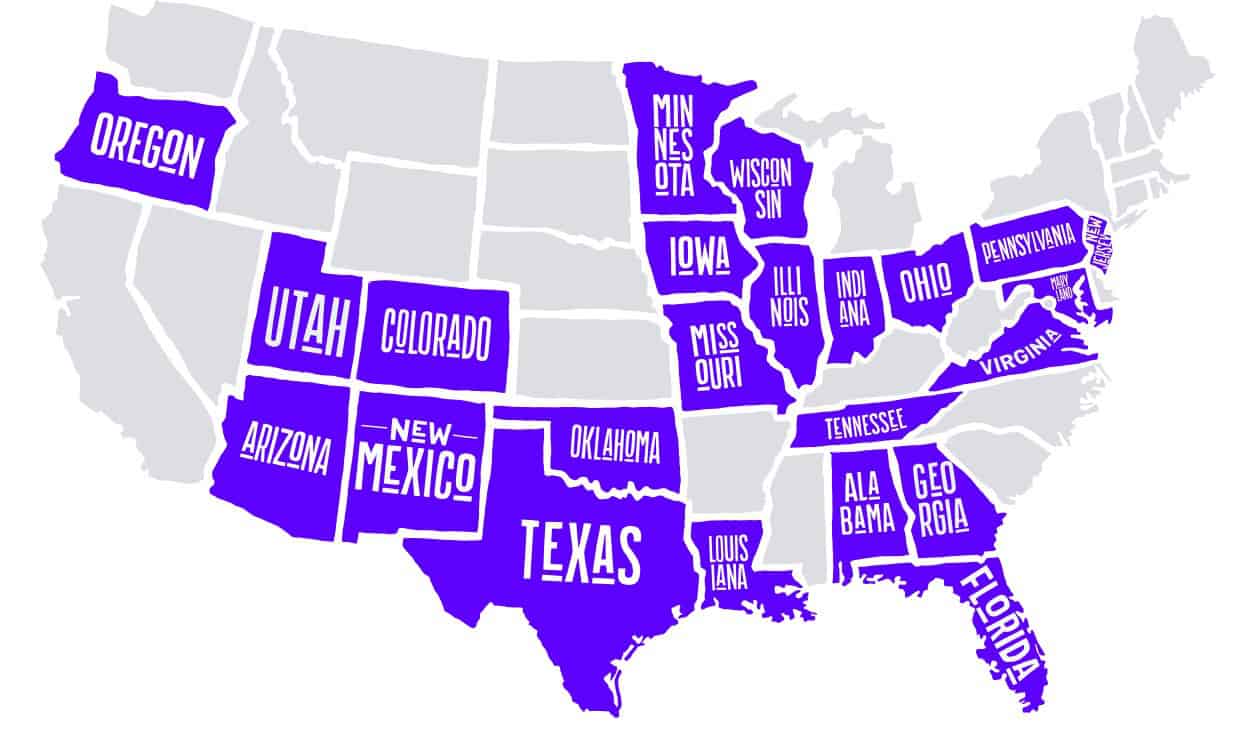

| VOOM pay‑per‑mile insurance | Riders pay a low base rate ($3–$30/month) plus a per‑mile charge (3–20 ¢/mile). Odometer photos are uploaded monthly. Full liability, collision and comprehensive options are available (trustedchoice.com). Policies are underwritten by Markel and can be cancelled anytime. | Ideal for low‑mileage riders who only ride occasionally; useful for seasonal riders who want to avoid paying for miles they don’t ride. | Some riders pay as little as ~$50/year (trustedchoice.com). Coverage is available in about 20 states (including AL, AZ, CO, FL, GA, IL, IN, IA, LA, MD, MN, MO, NJ, OK, OR, PA, TN, TX, VA and WI) |

| Cancel‑anytime annual policy (major insurers such as Progressive, GEICO, Dairyland) | You buy a standard annual policy and cancel it when you’re done. Progressive notes that you can cancel at any time; liability policies start around $75 per year. Cancelling may incur a fee but allows month‑to‑month flexibility. | Occasional riders who need coverage for a month or a few weeks. Also useful when you’re test‑riding a newly purchased bike or waiting for a long‑term policy to start. | Annual premiums for minimum coverage average about $68/month according to national surveys, while full coverage averages $148/month (insurify.com). You’re typically refunded unused premiums when you cancel. |

| Month‑to‑month or seasonal (lay‑up) policies | Some insurers allow you to buy monthly policies or reduce coverage in the off‑season. Trusted Choice notes that monthly motorcycle insurance can be renewed on a monthly basis and is ideal for travelers who only need coverage for the length of a vacation. Seasonal policies (sometimes called six‑month policies) provide coverage only during riding season (trustedchoice.com). Progressive and Allstate explain that you can lower liability limits or drop collision while the bike is in storage. | Seasonal riders who park their bikes in winter but still want theft and fire protection; riders who take extended trips and need coverage only while traveling. | Prices vary by state and carrier; expect higher per‑month rates than annual policies. Removing liability and collision in winter lowers premiums, but leaving only comprehensive coverage is recommended to protect against theft and weather damage (progressive.com). |

| Rental‑company insurance | Rental firms (e.g., EagleRider) provide short‑term coverage when you rent a bike. Daily plans typically include liability, and optional supplemental liability, collision or damage waivers. Rates start around $25–$35 per day. | Renters or tourists who need coverage for a few days. Coverage is tied to the rental agreement; you often must buy it even if you have your own insurance. | Supplemental liability and damage waivers cost about $25/day each, while damage‑and‑theft waivers can cost $35/day (vikingbags.com). Available wherever the rental company operates. |

| Adding a rider to an existing policy | If you borrow a friend’s motorcycle, the easiest path is to ride under the owner’s policy. Dairyland explains that an occasional borrower with the owner’s permission is typically covered. For regular use, insurers like Harley‑Davidson allow you to add a named rider; this requires providing the rider’s full legal name, license details and driving history. | Borrowing a bike from friends or family or letting someone test‑ride yours. | No extra cost for occasional borrowings when you’re covered by the owner’s policy. Adding a named rider may increase the premium slightly; cost depends on the rider’s experience and record. Available nationwide through most insurers. |

| Liability‑only policy for new‑bike test rides | Buying a very cheap minimum‑liability policy for a new or borrowed bike and cancelling it after your test ride. Some carriers allow coverage to be bound immediately by phone or online. | Riders who need proof of insurance to ride a bike home from the dealership or for a day of testing. | Minimal coverage costs vary by state but can be around $50–$100/month for bare‑bones liability. Be sure to cancel after the ride to avoid paying for the full term. |

What Temporary Motorcycle Insurance Covers

The protections available under a temporary or pay‑per‑mile policy are generally the same as those of a traditional motorcycle policy. Bodily injury liability covers injuries you cause to other people; property damage liability covers damage to someone else’s vehicle or property; collision covers repairs to your bike after a crash; comprehensive covers non‑collision perils such as theft, vandalism, fire and severe weather; and uninsured/underinsured motorist coverage protects you if you’re hit by a driver with insufficient insurance.

VOOM’s pay‑per‑mile plans offer these coverages, with three tiers: Rider’s Essentials (liability only), Popular (adds collision and comprehensive) and Extended (higher limits and uninsured/underinsured motorist) (trustedchoice.com).

Trusted Choice emphasizes that daily policies are usually offered through rental companies, while monthly or seasonal policies can be renewed month‑to‑month. Seasonal or “storage” policies provide only comprehensive coverage while the bike is stored, protecting against theft or damage but not covering you while riding. When financing or leasing, lenders often require keeping comprehensive and collision coverage year‑round, even when the bike is in storage.

Who Needs Temporary Motorcycle Insurance?

Temporary insurance isn’t for everyone, but it’s invaluable in several situations:

- Renters and tourists: Short‑term policies or rental‑company coverage are critical when you rent a bike for a day or a weekend. Trusted Choice notes that renters can invest in daily, weekly or monthly insurance depending on how long they plan to keep the rental.

- Travelers and snowbirds: Riders who only use their bikes on vacation or during winter in warm states can opt for temporary coverage during those trips.

- Seasonal riders: Those who park their bikes during winter but ride in summer can save by using seasonal or pay‑per‑mile policies.

- International visitors: Non‑U.S. residents riding in the U.S. need coverage without committing to long‑term policies.

- Low‑mileage riders: VOOM’s pay‑per‑mile model is designed for people who ride only occasionally. Because you pay based on mileage, low‑milers can save up to 60 % compared with traditional coverage (voominsurance.com).

U.S. Alternatives to True Short‑Term Insurance

Since few U.S. insurers offer single‑day motorcycle policies, riders often use one of the following alternatives.

Pay‑Per‑Mile Insurance

VOOM partners with Markel to offer the first mainstream pay‑per‑mile motorcycle insurance in the U.S. Riders pay a small base rate plus a few cents per mile, uploading an odometer photo each month to calculate charges. Coverage includes liability, collision, comprehensive and uninsured/underinsured motorist options.

Early reports show riders paying $3–$30 per month base plus 3–20¢ per mile; a low‑mileage rider may spend as little as $50 per year (trustedchoice.com). VOOM currently operates in about twenty states, and the company expects to expand. If you ride more than 2,000–3,000 miles annually, however, a traditional annual policy may be cheaper.

Want coverage that flexes with your mileage? See why pay-per-mile insurance can outsmart standard policies.

Cancel‑Anytime Policies and Month‑to‑Month Coverage

Most major insurers don’t sell “temporary” motorcycle insurance, but they allow you to cancel a policy at any time. Progressive’s answer page explains that you can cancel your motorcycle policy whenever you like; liability coverage starts at $75 per year. When you cancel early, any unused premium is refunded, though some insurers may charge a cancellation fee.

Trusted Choice notes that you can buy monthly motorcycle insurance and renew it monthly—a useful option if you’re traveling for a month and only need coverage for that period. Seasonal policies (often six months) allow you to buy coverage only for the riding season.

Storage or Lay‑Up Policies

During winter, riders often think about cancelling insurance altogether. Progressive and Allstate caution against doing so. Progressive notes that cancelling your policy in the winter leaves your bike unprotected against theft, fire or weather damage and may violate lease or financing agreements.

Allstate similarly advises riders to keep coverage because winter storage doesn’t eliminate risks and cancelling may not save money. A better solution is a lay‑up policy, which suspends liability and collision coverage but retains comprehensive coverage to protect against theft, vandalism and other non‑collision events. Some insurers allow you to mimic a lay‑up by lowering liability limits or dropping collision while the bike is in storage. Be sure to reinstate full coverage before riding again.

Adding a Named Rider or Borrowing a Bike

If you’re borrowing someone else’s bike, the simplest way to obtain coverage is to ride under the owner’s policy. Dairyland notes that for an occasional lend‑out with the owner’s permission, the borrower is typically covered under the owner’s motorcycle policy. When someone else rides your bike regularly, many insurers require adding that person as a named rider.

Harley‑Davidson’s insurance division says adding an additional driver is possible; the insurer will require the person’s full legal name, driver’s license details and driving history to assess risk. Once added, the named rider is specifically listed on your policy and coverage applies when they operate the bike. This option is ideal when a spouse or roommate frequently uses your motorcycle.

Rental‑Company Insurance

If you rent through a company like EagleRider or Riders Share, insurance is generally included or offered at the counter. Daily rates for rental insurance usually start at $25–$35, depending on the level of coverage. Supplemental liability and damage waivers at EagleRider cost around $25 per day, while a damage‑and‑theft waiver is about $35 per day.

These policies are convenient because they cover you for exactly the rental period, but they are expensive compared with pay‑per‑mile or short‑term options. They also often impose high deductibles (e.g., $2,000 for damage) (vikingbags.com).

How Much Does Temporary Motorcycle Insurance Cost?

Understanding the cost of short‑term motorcycle insurance requires looking at the different options:

- Pay‑per‑mile policies: VOOM charges a base fee of about $3–$30 per month plus a per‑mile rate ranging from 3 ¢ to 20 ¢. Trusted Choice notes that some riders can get a policy for as low as $50 per year. Actual cost depends on how much you ride; high‑mileage riders may pay more than for a traditional policy.

- Cancel‑anytime or monthly policies: Standard annual policies for minimal liability coverage average $68 per month, while full coverage averages about $148 per month (insurify.com). You may only need to pay for the months you’re covered if you cancel early. Progressive’s liability‑only policy starts at $75 per year.

- Seasonal or lay‑up coverage: Premiums vary because you’re buying a standard policy with reduced coverages for part of the year. Removing liability and collision while keeping comprehensive will reduce monthly payments, but exact savings depend on your insurer and state (progressive.com).

- Rental‑company insurance: Expect to pay $25–$35 per day for rental coverage, with additional fees for supplemental liability or damage waivers (vikingbags.com).

- Adding a named rider: There is usually no cost when a friend borrows your bike occasionally and is covered under your policy. Adding a regular rider may raise your premium slightly; the amount depends on the person’s driving record and insurance history.

Remember that insurance rates depend heavily on factors such as your age, riding experience, claims history, the bike’s type and value, and your state’s minimum requirements. Always get quotes from multiple providers to find the best rate for your situation.

Curious how temporary rates stack up against full-time coverage? Here’s what riders really pay across the U.S.

What to Watch Out For

Temporary and pay‑per‑mile insurance policies are not a magic bullet. Keep these caveats in mind:

- Limited state availability: VOOM’s pay‑per‑mile coverage is only available in about 20 states, so many riders cannot use it yet. Check whether your state participates before planning to rely on VOOM.

- Minimum mileage fees and caps: Pay‑per‑mile policies often include a minimum monthly charge plus a maximum mileage cap. If you ride a lot, the per‑mile charges could exceed a traditional annual policy.

- Odometer reporting: VOOM requires monthly odometer photos. If you forget to submit a photo, the company may estimate your mileage or charge a default amount.

- Cancellation fees: Some insurers charge a small fee for cancelling a policy early. Make sure the refund of unused premium outweighs the fee.

- Limited rental coverage: Rental‑company policies may come with high deductibles (e.g., $2,000 damage) and may exclude injuries to you or passengers unless you purchase additional coverage.

- Uninsured periods: Don’t ride without insurance, even for a day. Nearly every U.S. state requires riders to carry at least liability coverage. Riding uninsured could leave you liable for damages and result in legal penalties.

Buying Guide: Choosing the Right Short‑Term Coverage

Picking a temporary policy comes down to how, when and how often you ride. For riders focused on long-term savings, explore smart ways to cut motorcycle insurance costs year-round.

Use the following questions to narrow your options:

How often will you ride?

- Rarely (under a few hundred miles per year): Pay‑per‑mile insurance is typically the cheapest because you only pay for miles ridden. Upload your odometer photo monthly and track your riding to avoid surprises.

- A few months per year: Consider a seasonal or lay‑up policy. Keep comprehensive coverage year‑round to protect against theft and weather; drop liability and collision during storage.

- Year‑round but occasional: A standard annual policy with the option to cancel or adjust coverages may offer better overall value. You avoid lapses and may get multi‑bike or safe‑driver discounts.

Are you renting or borrowing a bike?

- Renting: Use the rental company’s insurance. Check the contract to see what’s included and decide whether to buy supplemental liability or damage waivers. Remember that daily rates can add up quickly.

- Borrowing a friend’s bike: Verify that your friend’s policy covers occasional riders. If you will ride regularly, ask them to add you as a named rider. If you own the bike and someone else will use it regularly, you may need to add them to your policy.

Do you finance or lease your motorcycle?

- Yes: Lenders typically require comprehensive and collision coverage even when the bike is stored. A lay‑up policy that maintains these coverages is safer than cancelling.

- No: You can lower your coverage during storage, but keep comprehensive to protect your investment.

What’s your budget and risk tolerance?

- Low upfront cost: Pay‑per‑mile or a liability‑only policy will have the lowest monthly payments, but you might pay more per mile if you ride often.

- Predictable expenses: Annual policies provide consistent premiums and may include discounts for bundling, safe riding, or paying in full (moneygeek.com). You can cancel anytime if your riding situation changes.

- High deductibles: Raising your deductible or taking a motorcycle safety course can reduce premiums.

How quickly do you need coverage?

- Immediate coverage for a test ride or new purchase: Purchase a basic liability policy online or over the phone. After your ride, you can cancel and refund the unused portion.

- Planned trip: Shop for quotes well in advance. Some insurers require a few days to process cancellations or modifications.

What coverage limits do you need?

- State minimums vs. adequate protection: Meeting your state’s minimum liability requirement is mandatory, but it may not cover all damages in a serious crash. Consider higher liability limits, especially when riding unfamiliar bikes or in busy areas. VOOM’s extended plan raises limits and includes uninsured/underinsured motorist coverage.

Final Thoughts

True “one‑day motorcycle insurance” is elusive in the U.S., but that doesn’t mean short‑term riders are out of luck.

VOOM’s pay‑per‑mile insurance—available in a growing number of states—offers savings for occasional riders by charging only for the miles you ride. Cancel‑anytime policies from mainstream insurers let you buy coverage for a month or two and receive a refund when you cancel. Seasonal or lay‑up policies allow you to keep comprehensive coverage during storage and drop other coverages. For rentals or borrowed bikes, rental‑company insurance or riding under the owner’s policy fills the gap.

The key is to avoid coverage gaps. Most states require liability insurance whenever you’re on the road, and lenders may require comprehensive coverage year‑round. Don’t risk riding uninsured; a minor accident could cost far more than a month of premiums.

Take the time to compare options, assess your riding habits, and choose the temporary motorcycle insurance strategy that keeps you safe and legal while fitting your budget.

Related

Classic Motorcycle Insurance: Protect Your Ride’s Legacy

If your ride’s got history, it deserves protection to match. Classic motorcycle insurance keeps legends alive and riders worry-free.